san antonio tax rate for cars

The 2018 United States Supreme Court decision in South Dakota v. Car insurance rates for a few popular vehicles in San Antonio include the Honda Civic at 1446 per year Toyota Tacoma at 1354 and GMC Sierra at 1486.

10 Things To Know Before Moving To San Antonio Tx

According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax.

. Some dealerships may charge a documentary fee of 125 dollars. Be prepared to pay a state car sales tax. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables.

Texas has 743 seperate areas each with their own Sales. The San Antonio sales tax rate is 825. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. In 1991 the tax rate was changed to the current rate of 625 percent.

The County sales tax rate is. The average cumulative sales tax rate in San Antonio Texas is 822. The first Texas motor vehicle sales and use tax rate in 1941 was 1 percent.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. How Does Sales Tax in San Antonio compare to the rest of Texas. City of San Antonio Attn.

The San Antonio sales tax rate is. What is the new car sales tax in San Antonio Texas. County tax assessor-collector offices provide most vehicle title and registration services including.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The Texas state sales tax rate is currently.

The sales tax for cars in Texas is 625 of the. Box 839950 San Antonio TX 78283. This is the total of state and county sales tax rates.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. There is no applicable county tax. The Texas sales tax rate is currently.

Object moved to here. Abilene TX Sales Tax Rate. 625 percent of sales price minus any trade-in allowance.

This percentage depends on your stateNote that some areas also have county city and even school district car taxes tooYour dealer will walk you through this process. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. The Bexar County sales tax rate is.

The December 2020 total local sales tax rate was also 8250. The tax rate varies from year to year depending on the countys needs. The current motor vehicle tax rate is 625 percent.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The state in which you live. The minimum combined 2022 sales tax rate for Bexar County Texas is.

1000 City of San Antonio. New car sales tax OR used car sales tax. The San Antonio sales tax rate is.

The type of license plates requested. Sales tax in San Antonio Texas is currently 825. The current total local sales tax rate in San Antonio TX is 8250.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. 0250 San Antonio ATD Advanced Transportation District. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate.

San Antonio TX 78207. 0500 San Antonio MTA Metropolitan Transit Authority. Patricks Day ends with car crashes in San Antonio area.

The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention. Tax and Tags Calculator. The Texas Legislature increased the rate in subsequent years.

See the historical rates below. Cares check implications stimulus Edit. San Antonios current sales tax rate is 8250 and is distributed as follows.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. This includes the rates on the state county city and special levels. There is no applicable county tax.

0250 San Antonio ATD Advanced Transportation District. 0125 dedicated to the City of San Antonio Ready to Work Program. Whether or not you have a trade-in.

The county the vehicle is registered in. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Models like the Mazda CX-5 Chevrolet Trailblazer and Nissan Kicks rank high for cheap car insurance in San.

In a unanimous vote of the 10 members present Thursday morning San Antonio City Council approved raising the homestead exemption from the minimum 001 or 5000 up to 10 of a homes value. The minimum combined 2022 sales tax rate for San Antonio Texas is. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value.

This is the total of state county and city sales tax rates. San Antonio has parts of it located within Bexar County and Comal County. Average car insurance in San Antonio costs 1458 per year or 122 per month for full coverage.

You can find these fees further down on. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Has impacted many state nexus laws and sales tax.

Shop Used Cars in. Car Tax Rate Tools. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245.

0250 san antonio atd advanced transportation district. Unfortunately dealership andor manufacturer rebates and other incentives might not help you when it comes to lowering the cost associated with car. 825 City Sales Tax Rate Tax Jurisdiction Universal City 825 Universal City.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Fill in price either with or without sales tax.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

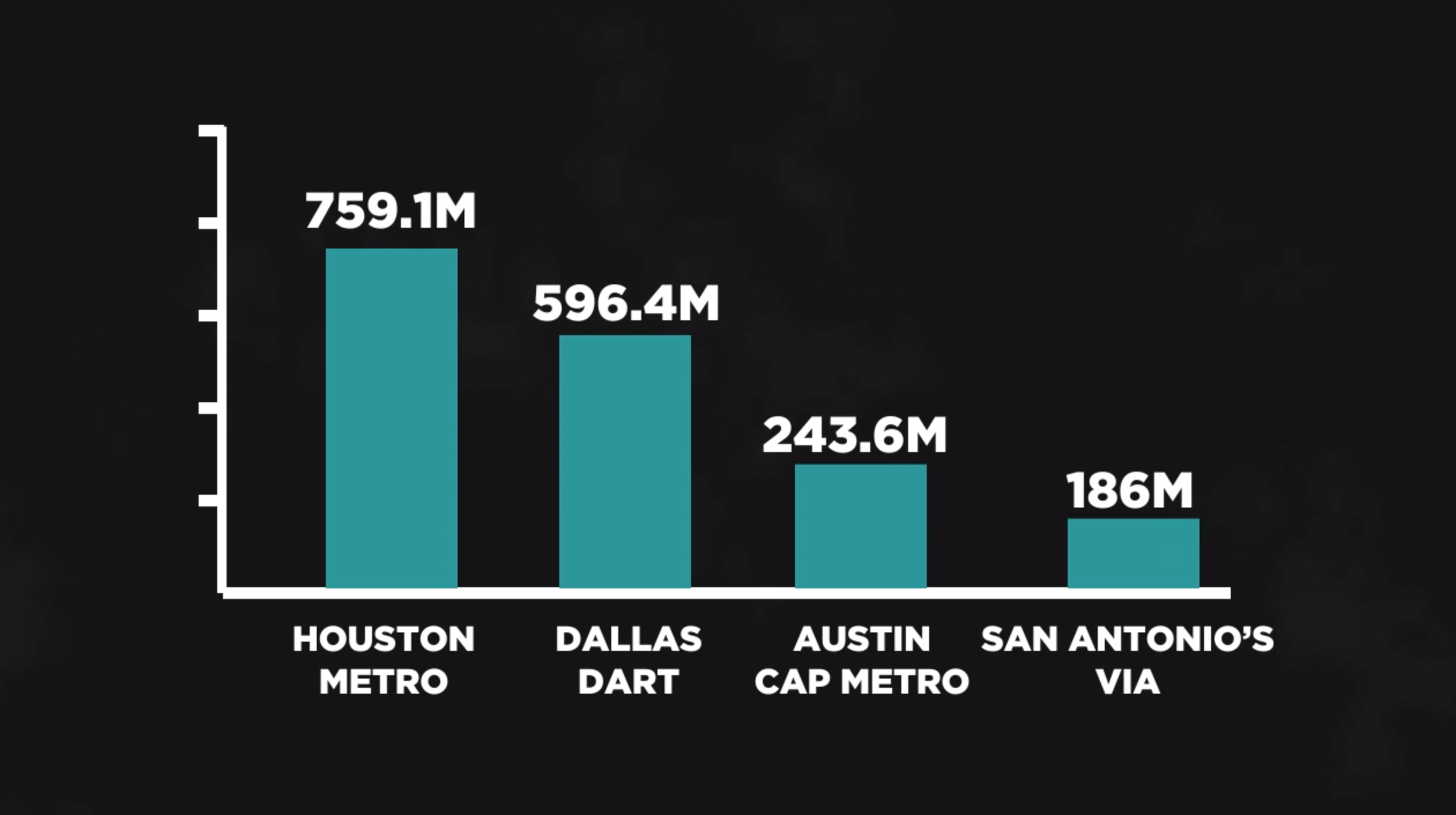

Why Does San Antonio Struggle With Mass Transit Ksat Explains

Pin On Criminal Defense Attorney

Stay At Menger Hotel In San Antonio Tx Visit San Antonio San Antonio Riverwalk San Antonio Things To Do

Trucking Driver Training Program Situated San Antonio Standard Truck Bring Every Aspect Necessary For Getting Cdl C Truck Driving Jobs Trucks Truck Dispatcher

Wednesday Word Of The Week Piti Piti Is An Acronym For A Mortgage Payment That Is The Sum Of Monthly Principal Int Mortgage Payment Mortgage Real Estate Tips

How San Antonio Measures Up To Other Fast Growing Tech Cities San Antonio Business Journal

Solved Abe Forrester Solutionzip How To Plan Finance Plan Venture Capitalist

Register For A Free Irs Webinar On Helping Small Business Owners Like Yourself Succeed Business Tax Small Business Owner Business Owner

Boston Indian Cpa San Antonio Indian Cpa Mytaxlinx Internal Revenue Service Irs Tax Deductions

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Wolseley 1500 Beryl C1960 Commercial Vehicle Classic Cars British Cars

10 Best Places To Retire Flyer Postcard Best Places To Retire Flyer Postcard

San Antonio Tx San Antonio Riverwalk Places To Visit Places To Travel

Living In San Antonio 40 Things You Need To Know Before Moving Here Bhgre Homecity